In recent years, the global market for cutting tools has witnessed significant transformations, and one of the standout components driving this change is Pcbn inserts (Polycrystalline Cubic Boron Nitride inserts). According to a report from Market Research Future, the global Pcbn tools market is projected to grow at a CAGR of 5.8%, reflecting the rising demand in high-precision machining sectors, particularly in the automotive and aerospace industries.

China has emerged as a powerhouse in this field, leading the export of Pcbn inserts due to its advancements in manufacturing technology and competitive pricing strategies. This dominance not only highlights China's capability in producing high-quality tools but also raises questions about the implications for global supply chains and the competitive landscape. As we delve deeper into the intricacies of Pcbn inserts, we will uncover the factors contributing to China's leadership in the industry and explore what this means for manufacturers and engineers worldwide.

China’s PCB inserts market is characterized by a rigorous framework of industry standards and certifications that ensure quality and reliability. As the demand for high-performance components continues to rise globally, China's manufacturers are stepping up to meet these needs by adhering to international standards, such as ISO and IPC certifications. This dedication to quality not only enhances their domestic production capabilities but also strengthens their position in the global supply chain.

In contrast, while China's PCB inserts dominate the market, other players, such as those in the Indian electronics industry, must navigate their own challenges. India, with its burgeoning electronics sector valued at an impressive $1.75 trillion, represents both a competitive landscape and a significant opportunity for growth. As leading EMS players in India emerge, the focus on developing robust standards will be crucial for their success. Establishing a framework comparable to that of China's will be essential for sustaining quality and attracting global partnerships as the industry evolves.

This chart illustrates the market share of different types of PCB inserts in China for the year 2023. The data reflects the growing demand for advanced materials and technologies within the industry.

In recent years, digital technology has revolutionized the production landscape of PCB (printed circuit board) inserts in China. The adoption of advanced technologies such as artificial intelligence, machine learning, and IoT has significantly streamlined manufacturing processes. By leveraging these innovations, Chinese manufacturers can optimize production schedules, reduce waste, and enhance quality control. This proactive approach not only increases output but also improves the overall efficiency of the production line, making it easier for China to maintain its foothold in the global market.

Moreover, digital technologies play a crucial role in improving export logistics for PCB inserts. Sophisticated data analytics tools enable manufacturers to track shipments in real-time and predict potential delays. This capability is vital for meeting the growing demand in diverse international markets. Additionally, the integration of digital supply chain management systems allows for better coordination among suppliers, manufacturers, and logistics providers, resulting in timely delivery of products. As a result, China continues to lead the charge in the global PCB insert industry, setting standards that others strive to achieve.

China is rapidly positioning itself as a dominant player in the global PCB inserts market. With a significant share of the industry, China's innovative approaches and advanced manufacturing capabilities have allowed it to outpace many competitors. Analysis from recent industry reports indicates that China currently holds approximately 45% of the global PCB insert production, significantly leading over other contenders. The continuous investment in research and development sets Chinese manufacturers apart, enabling them to produce high-quality products at competitive prices.

China is rapidly positioning itself as a dominant player in the global PCB inserts market. With a significant share of the industry, China's innovative approaches and advanced manufacturing capabilities have allowed it to outpace many competitors. Analysis from recent industry reports indicates that China currently holds approximately 45% of the global PCB insert production, significantly leading over other contenders. The continuous investment in research and development sets Chinese manufacturers apart, enabling them to produce high-quality products at competitive prices.

While China is making strides, it's essential to recognize the ongoing challenges it faces in high-tech sectors like semiconductors. Reports suggest that while China is progressing, it remains about five years behind leading global manufacturers in producing advanced semiconductor chips. This gap highlights the need for further innovation and strategic investment in emerging technologies to maintain its leadership position in related markets.

Tips:

When sourcing PCB inserts, consider focusing on suppliers that prioritize R&D to ensure access to the latest innovations. Additionally, keeping an eye on global market trends can provide insights into pricing and quality standards. Exploring partnerships with manufacturers who demonstrate a robust commitment to quality can also lead to more sustainable supply chains.

China has emerged as a powerhouse in the global market for PCBN (Polycrystalline Cubic Boron Nitride) inserts, attributed not only to its superior manufacturing capabilities but also to its strategic navigation of import and export regulations. By leveraging government support and establishing robust relationships with international partners, China has enhanced the accessibility of its high-quality products to global markets.

When engaging in international trade, it is essential to understand the regulations that govern each market. Tip: Always stay informed about the specific import tariffs and regulations prevalent in your target countries. Partnering with local trade experts can also provide invaluable insights. Additionally, ensure that your products comply with international quality standards to facilitate smoother transactions.

Moreover, China's approach to building a resilient supply chain further solidifies its dominance. By optimizing logistics and adopting advanced technology, manufacturers can reduce lead times and costs. Tip: Regularly assess your supply chain strategy and adopt flexible practices that can adapt to changing regulations and market demands. This adaptability is crucial for maintaining a competitive edge in the export market.

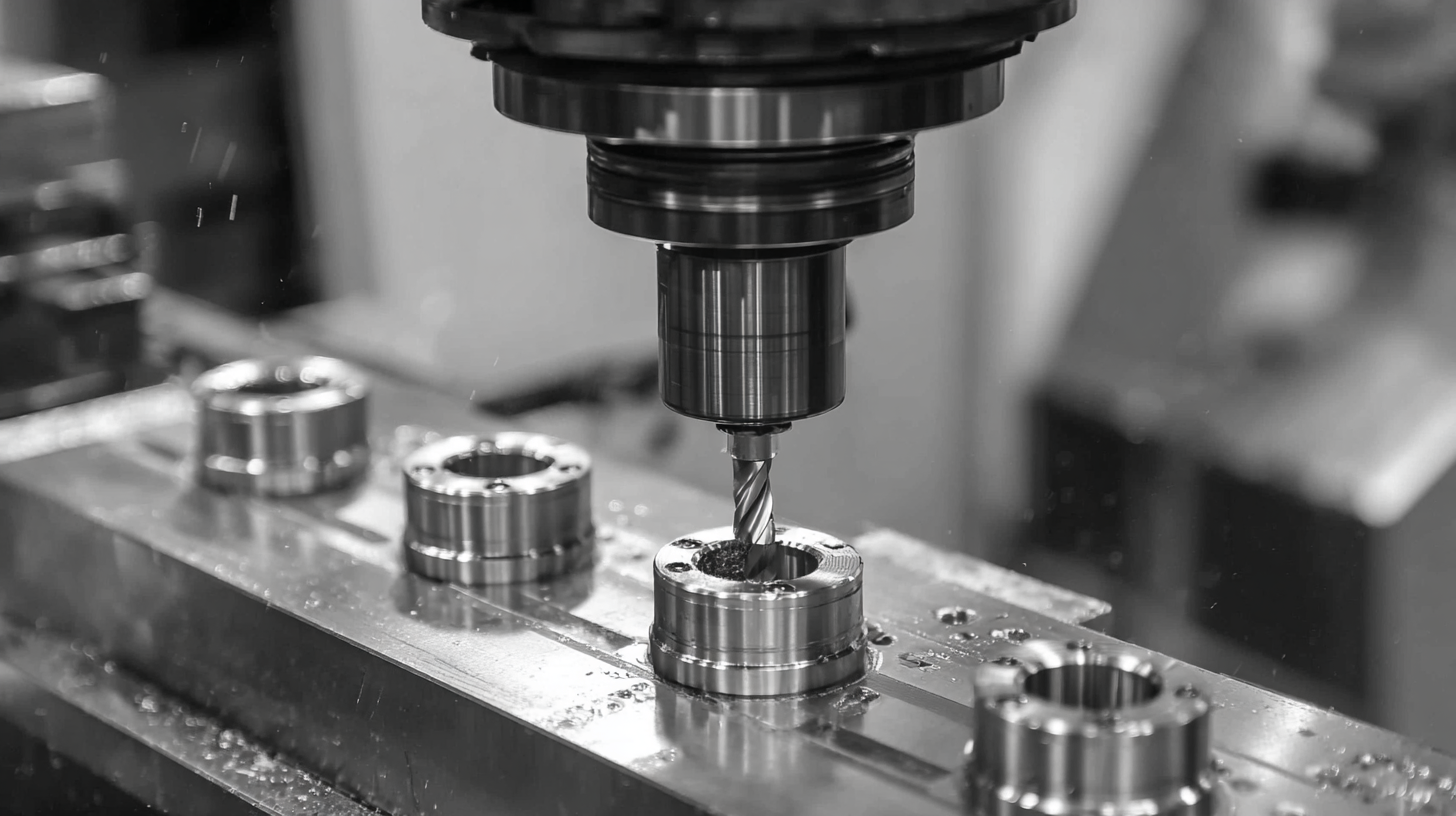

The PCB insert industry is undergoing a transformative phase, fueled by innovations in materials and manufacturing technologies. China has positioned itself at the forefront of this evolution with its advanced PCBN (Polycrystalline Cubic Boron Nitride) inserts. These inserts have gained prominence due to their superior hardness and thermal stability, making them essential for high-precision machining in various industrial applications. Manufacturers are increasingly investing in research and development to enhance the performance and longevity of these inserts, thereby setting a new standard in the global marketplace.

As global demand for high-quality machining tools rises, the landscape of PCB inserts continues to evolve. Emerging trends such as automation, smart manufacturing, and the use of artificial intelligence in production processes are accelerating the pace of innovation. Companies that embrace these advancements position themselves to not only meet but exceed international standards, driving growth in exports. With factors like sustainability becoming critical, the PCB insert industry is also seeing a shift towards eco-friendly manufacturing practices, making the future of this sector both promising and dynamic.

| Country | Market Share (%) | Key Innovations | Projected Growth Rate (2024-2028) (%) |

|---|---|---|---|

| China | 45 | Advanced Coating Techniques | 10 |

| USA | 25 | High-Performance Materials | 5 |

| Germany | 15 | Eco-Friendly Solutions | 6 |

| Japan | 10 | Miniaturization Techniques | 7 |

| South Korea | 5 | Thermal Management Technologies | 8 |